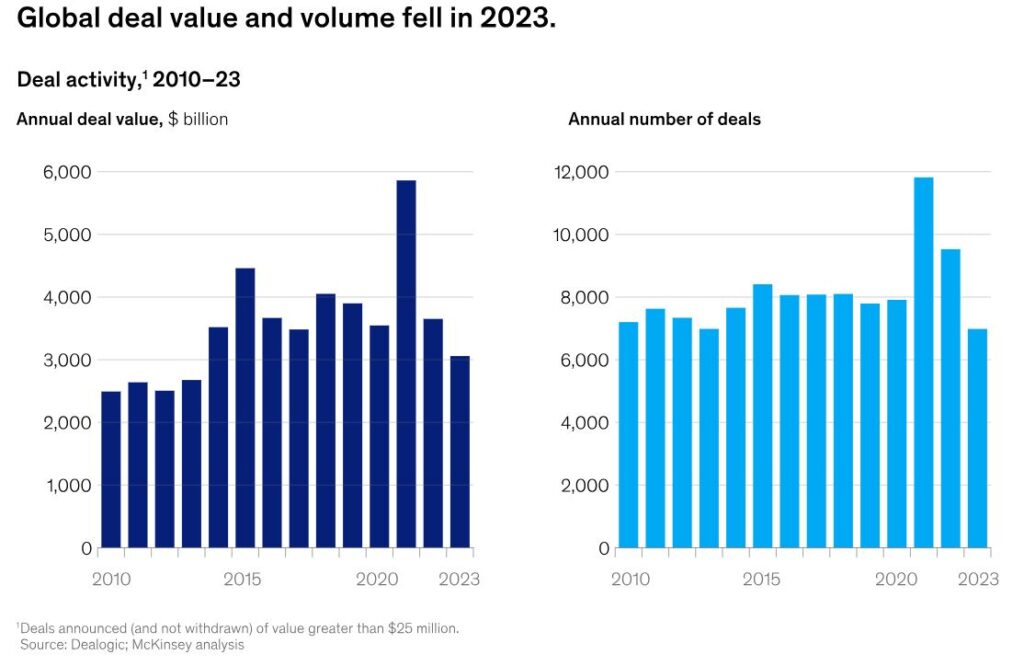

2023 was not a great year for M&A deal activity, largely due to inflation, rising interest rates, and other economic concerns.

Overall, global annual deal value decreased by 16% to approximately $3.1 trillion. Meanwhile, the total number of M&A deals in 2023 fell by 27% compared to 2022 activity.

However, there are reasons to be optimistic for 2024 and beyond. Global private equity dry powder currently sits at an all-time record high of $2.49 trillion. While firms may not feel pressure just yet to put that capital to work, an increase in M&A is on the horizon as rate cuts and economic improvements occur.

In these current conditions, M&A deal sourcing is more important than ever. Finding quality deals is not as easy, so unlocking new strategies that result in higher success rates is essential.

Below, we examine our proven M&A deal sourcing strategies and explain how anybody can implement them into their daily workflow.

What Is M&A Deal Sourcing?

M&A deal sourcing or deal origination is when firms and investors go through the process of finding, researching, and vetting potential investment opportunities. But it’s best to think of this as only the first step in the M&A process.

While this is only one piece of the puzzle, finding quality leads and investment opportunities is one of, if not the most critical, steps to closing a deal. This is exactly why the primary goal of any firm or investor should be centered around deal sourcing.

However, deal sourcing is not merely about finding any available opportunity. Rather, it’s about identifying the right opportunities that fit a specific investment thesis, company profile, or pre-set criteria. For M&A professionals, effective deal sourcing is both an art and a science. The firms who master it quickly rise to the top.

Why You Need M&A Deal Sourcing

The ability to identify, evaluate, and secure high-quality deals ahead of competitors is a substantial strategic advantage to have. That’s where effective deal sourcing comes into play, especially in the current fast-paced world of mergers and acquisitions.

Competitive Advantage

In the fast-paced world of M&A, being first to identify and engage with potential targets can provide a significant edge. Effective deal sourcing allows you to:

- Engage with targets before competitors become aware of the opportunity

- Build relationships with key decision-makers early in the process

- Potentially secure more favorable terms due to reduced competition

As one M&A expert notes, “In today’s market, the ability to source proprietary deals is often the difference between winning and losing.”

Access to Quality Deals

A robust deal sourcing strategy ensures a steady flow of high-quality opportunities. This is critical because:

- It increases the likelihood of finding deals that truly align with your strategic objectives

- A larger pool of potential targets allows for more selective decision-making

- Consistent deal flow can help maintain momentum in your M&A program

According to a recent study, companies with structured deal sourcing processes are 2.5 times more likely to achieve their M&A objectives than those without.

Strategic Alignment

Effective deal sourcing isn’t just about quantity. But rather finding opportunities that align with your company’s strategic goals. This alignment is crucial because:

- It ensures that acquisitions contribute to long-term growth and value creation

- It helps in identifying targets that offer significant synergies

- It reduces the risk of pursuing deals that may look attractive on paper but don’t fit with the overall strategy

As noted by a leading M&A advisor, “The most successful acquirers have a clear strategic rationale for every deal they pursue, which starts with how they source their opportunities.”

Risk Mitigation

A well-structured deal sourcing process incorporates early-stage due diligence, helping to identify potential risks before significant resources are committed. This is important because:

- It allows for early identification of red flags or potential deal-breakers

- It provides more time for thorough due diligence on promising opportunities

- It can help avoid costly mistakes by filtering out unsuitable targets early in the process

Research shows that companies with robust deal sourcing and screening processes are 28% more likely to report that their deals have created value.

Top 8 M&A Deal Sourcing Strategies for 2024

Below, we uncover our top 8 deal sourcing strategies in 2024. From working with a deal flow sourcing partner to expanding your network at industry events, there’s something for every investor looking to increase their M&A deal flow.

1. Utilize a Deal Flow Sourcing Partner

A deal flow sourcing partner or service provider is like having your lead generation on autopilot. Rather than combing through databases with thousands of investment opportunities or deep diving through your CRM, a partner like Falcon River will bring available off-market deals directly to you.

Typically, firms and investors face major challenges when building a deal flow pipeline or accessing quality deals. Utilizing Falcon River is like skipping to the front of the line. We handle all the research and bring deals that match your investment thesis or strategy.

The filtering process to find targeted deals is what makes a deal flow sourcing partner so valuable. Thanks to our proprietary search technology, we can find highly specific potential acquisition targets that fit your criteria at scale. And our service bridges the gap between the buyers and sellers. That means faster negotiations and better deals for both sides.

2. Regularly Interact With Your Network

Everybody has heard the saying, “Your network is your net worth,” which couldn’t be more true in the M&A and deal sourcing world. Consistent engagement with your professional network helps build better relationships, ultimately leading to valuable new opportunities within your space.

Don’t believe it? Well, according to Janne Korpela (a former VC founder), VCs rely on their network and referrals for up to 80% of their deal flow.

A strong network can help in a few ways by providing you with:

- Better access to quality deals

- Access to industry professionals for expertise and advice

- Expertise and authority within your niche

- Co-investment or syndication opportunities

However, a strong network must be nurtured properly to produce real results with regular referrals or deal flow. The best way to stay consistent is to use networking apps and CRM tools to track interactions and set follow-up reminders. However, to see better deal sourcing results, aim to focus on meaningful interactions rather than superficial touchpoints.

3. Take Advantage of Online Deal Platforms

Taking advantage of online deal platforms has become an essential strategy for M&A deal sourcing for several reasons. First, the sheer volume of data and the number of potential deals you can access are unmatched.

Platforms like Dealroom, Pitchbook, and SourceScrub are all great options. But before choosing a platform, think about your end goal. Hasan Minhal, Investment Banking Associate at Incedo, says, “Start by defining the firm’s investment criteria, including target industries, geographic focus, deal size, return expectations, and risk appetite.”

For example, if financial research were a top priority in your investment thesis, then opting for Pitchbook over other alternatives would be more beneficial.

4. Establish a Brand Presence on Social Media and Professional Networks

Social media and professional networks have changed how we do business, even in venture capital and M&A. According to a study by Intralinks, more than 55% of dealmakers use online networks for deal sourcing.

While social media can be used as an outbound tool, we prefer it as an inbound deal sourcing tool. Investors can become authorities within their space by regularly posting informative content on these platforms. Thanks to the advanced algorithms on platforms like X and LinkedIn, that content will find your target audience.

Jason McCabe Calacanis and Nicole DeTommaso are two examples of how this strategy works. On X, they post helpful content and personalized insights related to what they invest in. Today, they’re recognizable names by startup founders in their space looking for capital.

5. Use Tech To Set Up Growth Monitoring Alerts

Staying ahead of emerging opportunities is a winning strategy in any industry, especially in M&A. One effective way to do this is by setting alerts for company growth. Essentially, you’ll be alerted about new fast-growing companies that could be prime acquisition targets.

Growth monitoring alerts provide immediate updates on significant developments, such as revenue growth, market expansion, or changes in leadership.

First, set specific metrics that are most relevant to your M&A strategy. Then, consider tools like Google Alerts, Bloomberg Terminal, or specialized M&A software to get started.

Tailor your alert settings to ensure you receive timely and relevant notifications. Ideally, your tool should integrate with your existing CRM to make outreach easier.

6. Partner With Intermediaries

Partnering with intermediaries such as brokers, bankers, and advisors is a strategic move in the mergers and acquisitions process. Not only is this a reliable way to increase the number of deals you source, but deal quality also improves and now you have access to a strategic partner with specialized expertise and resources.

However, choosing intermediaries to work with can be a tedious balancing act while simultaneously implementing other deal sourcing strategies. For the best success, look for intermediaries with a proven track record in your sector. Relevant industry expertise is most important when partnering up.

The primary advantage of selecting the right M&A intermediary is their capacity to enhance deal outcomes. With expert guidance and access to more strategic connections, a well-aligned intermediary streamlines transactions and uncovers hidden deal opportunities.

7. Attending Industry Events

Expanding your professional network is one of the most effective ways to position yourself for new deal opportunities. Relevant industry events within your niche or sector are great places to do so. This includes conferences, trade shows, networking sessions, or joining associations.

Establishing personal connections can lead to valuable introductions and insights that may not be accessible through traditional channels. In my experience, events like these are where you can uncover potential acquisition opportunities.

But always target events within your space. If you’ve already built authority in that niche, it’ll help even more when talking with companies. It also opens the door for you to participate in these events as a speaker. This is how many firms attract potential targets and partners who are looking for reputable buyers.

8. Cold Outreach to Highly Specific Companies

Like many sales teams filling their company’s funnel with leads, many M&A deals come from cold outreach, too. But, because of the high volume required in a standard cold outreach campaign due to low conversion rates, the key differentiator to keep in mind is only targeting highly specific companies.

This ties back to your investment thesis, which you likely developed early on as a firm. Begin by identifying companies that align with your strategic objectives. Use databases and tools to compile a list of prospects that fit specific criteria, such as industry, size, and geographic location.

Sal Piscopo, founder and managing director at Ether Advisory Partners, mentions a few ways to leverage cold email in the origination of M&A deals. Most importantly, stay persistent without being spammy. Sal says he’ll contact the same person three or four times before moving on to a new lead or a different title in the same organization. It’s the only way to keep a funnel full of new targets.

How To Use AI In M&A Deal Sourcing

Artificial intelligence is changing the way M&A professionals can source deals by adding new levels of efficiency and precision to their processes. In fact, 75% of VC and early-stage investor reviews will be using AI by 2025. That means if you’re not using AI, you’ll fall behind.

But how is it done? Can every firm upgrade its tech stack to include AI? Let’s take a look at how to properly use AI in M&A deal sourcing in 2024.

Identifying Targets

AI can automate the identification of potential acquisition targets, reducing the manual hours required to create your database. In many cases, AI can dig deeper by analyzing financial reports, news articles, and social media for specific triggers. For example, machine learning algorithms can detect patterns and signals that indicate a company is a prime acquisition candidate.

One tool that does this well is Cyndx. By leveraging AI and natural language processing to sift through extensive datasets, users can find relevant companies and emerging trends in their space. These insights lead to faster investment opportunity discovery.

Automated Due Diligence

Beyond deal sourcing, AI also streamlines the due diligence process by automating document review and data analysis. Imprima AI analyzes large volumes of unstructured data and offers actionable insights like smart summarization or automated categorizing.

In my experience, a tool like Imprima allows the research team to function at a higher level by allowing them to focus on more advanced tasks.

Continuous Monitoring

Identifying targets is only one piece of the puzzle. In the M&A deal sourcing process, continuously monitoring these targets for significant events like product launches or management changes is necessary. AI tools make this much easier with real-time tracking and alert features.

The Synexo deal analytics platform continuously monitors target companies. This reduces the need for manual market monitoring and keeps dealmakers informed of optimal moments for M&A discussions

Inbound Vs. Outbound Deal Sourcing

Overall, M&A deal sourcing can be split into two categories: inbound and outbound. Inbound deal sourcing relies on attracting potential deals through different channels based on a company’s reputation or authority.

On the other hand, outbound deal sourcing requires investors to be more aggressive by proactively pursuing potential targets through research, cold outreach, and strategic networking. Combining both is how the top M&A professionals dominate their respective sectors.

What is Inbound Deal Sourcing?

Inbound deal sourcing is when potential M&A opportunities come to you rather than performing traditional outreach methods to secure deals. Outbound requires more upfront work through outreach, while inbound deal sourcing relies on your strong presence and reputation in the market.

This can be done through social media, blogging, and other thought leadership content. Inbound is like earning while you sleep. Previously posted content can work for you 24/7, allowing potential deal partners to seek you out because of your authority and expertise in their field.

Common Methods and Tools

- Content Marketing: Publishing insightful articles, whitepapers, and case studies that showcase your expertise and attract potential leads.

- Search Engine Optimization (SEO): Optimizing your online content to rank higher in search engine results where potential targets can find you.

- Social Media: Actively participating in social media platforms like LinkedIn to build a network and engage with potential leads.

- Webinars and Podcasts: Hosting or participating in webinars and podcasts to share knowledge and connect with industry professionals.

- Referral Programs: Encouraging satisfied clients and partners to refer potential leads to your firm.

What is Outbound Deal Sourcing?

Outbound deal sourcing requires a more hands-on approach. Think of outbound as the typical door-to-door salesman. This is when you approach potential M&A targets through different outbound channels like email, phone, social media DMs, etc.

This method requires a more hands-on approach, emphasizing research, outreach, and relationship building. It tends to have a lower conversion rate, meaning higher volume is key in outbound deal sourcing.

Common Methods and Tools

- Cold Outreach: Reaching out to potential targets via phone calls, emails, or LinkedIn messages to initiate conversations.

- Networking and Industry Events: Attending conferences, trade shows, and industry events to meet potential targets and build relationships.

- Utilizing Intermediaries: Working with brokers, investment bankers, and other intermediaries who can introduce you to potential targets.

- Market Research: Conducting in-depth research to identify potential targets that align with your strategic goals.

- Outsourced Telemarketing: Engaging third-party firms to conduct outreach on your behalf.

M&A Deal Sourcing Best Practices

Finding promising M&A deals can be simplified into a well-thought-out approach that is both simple and strategic. In our experience, the best M&A deal sourcing strategies align with a few best practices to yield the most impressive results. Firms and investors can:

Utilize Proprietary Technology and Data

Using the same information as everybody else will yield the same results. If your goal is to find deals nobody else has access to, you’ll need to leverage proprietary technology and data like Falcon River can provide.

Falcon River uses advanced algorithms to offer off-market acquisition targets that match your investment goals. Our service completely automates the initial stages of deal sourcing and screening, allowing your firm to reallocate resources to other areas like relationship building and negotiation.

Develop and Refine Their Investment Thesis

Successful M&A professionals clearly define their investment thesis before they start sourcing deals. A well-crafted thesis aligns with the firm’s strategic objectives and adapts to changing market conditions. Otherwise, it becomes impossible to refine a search when doing outbound.

This drives up the cost of outreach, reducing your ROI and likelihood of securing a new investment. The same is true for inbound. Building authority or gaining niche expertise requires you to understand your niche completely first.

Continuously Refine Their Process

Lastly, top M&A professionals recognize that deal sourcing is an iterative process that requires constant refinement. This includes tracking key KPIs and having some sort of feedback loop in place that allows you to compare the performance of different deal sourcing strategies.

Common M&A Deal Sourcing Challenges

There’s not necessarily a one-size-fits-all approach to M&A deal sourcing. Firms and investors in different sectors may notice a higher or lower success rate with one strategy than another. However, knowing about these common challenges is helpful for creating consistent performance that you can trust.

Market Volatility

Market volatility significantly impacts the M&A landscape because investors tend to adjust how they allocate capital. This can make it challenging to predict and identify viable deal opportunities.

Economic fluctuations, geopolitical events, and changes in regulatory environments can all contribute to market instability. This uncertainty can deter potential sellers from entering the market or cause buyers to hesitate, complicating the deal sourcing process.

Lack of Quality Data

Without quality data, acquiring companies is like shooting fish in a barrel. It becomes impossible to generate quality leads, which only requires more work during the screening, due diligence, and partner review stages. This increases man hours and lowers your firm’s close rate.

Incomplete or outdated information can lead to poor decision-making and missed opportunities. I’ve also noticed that the cost of acquiring premium data sources can be prohibitive for some firms. This can really limit their ability to perform thorough market analysis and due diligence.

Competition for Deals

The competitive nature of the M&A market means that multiple firms are regularly vying for the same high-quality targets. This competition can drive up valuations and capital demands, making it more difficult to secure favorable terms.

Beyond that, the presence of larger, more established players with greater resources can overshadow smaller firms, reducing their chances of winning deals.

Resource and Expertise Constraints

Effective deal sourcing requires a dedicated team with specialized skills and expertise. However, many firms face constraints in terms of both human and financial resources.

Smaller firms, in particular, may struggle to allocate sufficient resources to deal sourcing activities, limiting their ability to identify and pursue potential opportunities. The lack of experienced personnel can hinder the effectiveness of the deal sourcing process.

How M&A Industry Leaders Automate Their Deal Sourcing

If your firm still relies on large databases to juggle deal opportunities or spends hours putting together cold outreach campaigns, there could be a better alternative you haven’t thought of yet.

Falcon River’s proprietary technology and tailored approach to finding highly specific off-market deals can automate the deal sourcing process for many M&A firms. Instead of juggling a handful of deal origination strategies, we bring the best opportunities right to you.

Rather than wasting manpower on multiple sourcing strategies, you can allocate more resources down the deal flow funnel because we handle the sourcing and screening for you.

Falcon River’s deal-flow service connects buyers and sellers by:

- Identifying highly specific opportunities that align perfectly with your acquisition criteria.

- Finding hidden gem off-market deals that aren’t available through traditional channels.

- Providing actionable data on potential targets to improve the decision-making process.

Find out how you can get started today with Falcon River’s deal flow service to automate your M&A sourcing.