Because of rising interest rates, private equity investments declined by 37% in 2023.

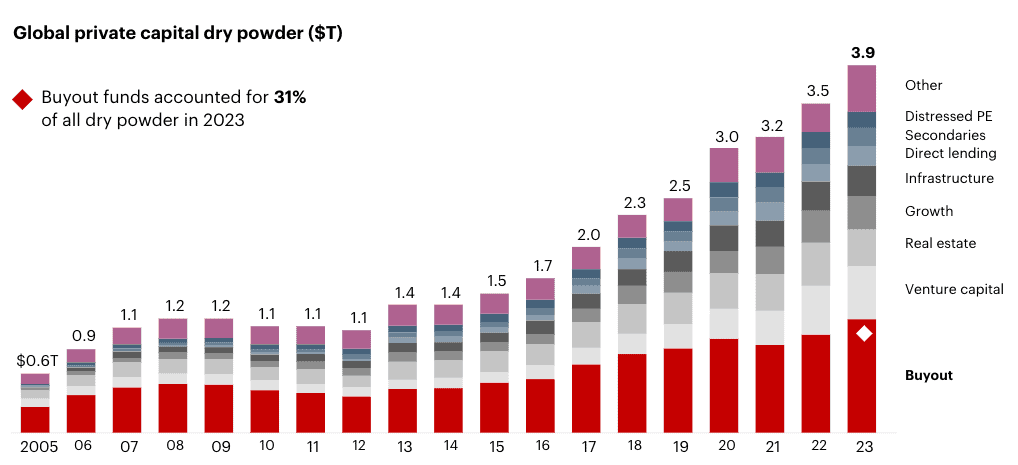

Investments have taken such a hit that global dry powder across private asset classes has reached an all-time high.

That’s a good sign for investors and founders looking to increase deal flow.

Between the need to put this increased cash flow to work and projected rate cuts, private equity investments are expected to recover in 2024 and beyond.

With this in mind, shifting the focus to generating deal flow in preparation for an uptick in investments should be a top priority.

But producing more deal flow is not necessarily the end-all solution, increasing quality deal flow is far more important. Below, we’ll cover the deal flow process, reliable deal generation sources, and eight proven ways to increase deal flow.

What Is Deal Flow?

Simply put, deal flow is the number of investment opportunities and business offers an investor receives. Deal flow is considered positive when a firm has enough opportunities to keep operations running at peak capacity.

Deal flow is the lifeblood of VC and PE firms – from sourcing potential investment opportunities to closing deals. But it’s also equally important to business aggregators and individual entrepreneurs looking to find new deals or cash in on an existing venture.

The process typically involves several stages: deal sourcing, deal screening, stakeholder or partner review, due diligence, and transaction. Effective deal flow management ensures that firms can identify, evaluate, and invest in the best opportunities available.

How Does The Deal Flow Process Look?

Deal flow is a structured, multi-step process to maximize investment potential through the identification, evaluation, and execution of investment opportunities. In my experience, successful deal flow includes the following six phases.

Sourcing Potential Deals

The first step to start securing new investment opportunities is deal sourcing. This is where we identify potential investment opportunities through:

- Networking and Relationships

- Deal Sourcing Tools

- Industry Events and Conferences

- Intermediaries

All deal sourcing starts with networking and industry relationships. Building and maintaining strong connections with other investors, entrepreneurs, and professionals in your sector can result in a steady pipeline of deals.

As our network grows, so does our ability to automate steps in the process. This is where deal sourcing tools come in handy. Modern technologies, such as AI-driven deal-sourcing tools, can facilitate the process by providing faster access to real-time insights across industries.

Other deal sourcing techniques, like attending industry events and conferences, can help connect with potential investment opportunities and stay updated on market trends. I’ve also found these events to be a good place to meet and connect with investment bankers, brokers, and M&A intermediaries who specialize in connecting buyers and sellers.

Deal Screening

After finding potential investments, deal screening is necessary as a preliminary evaluation step to determine if they meet specific investment criteria. The deal screening process includes a few key steps:

- Initial Due Diligence

- Screening Questions

- Pass/Fail Verdict

- Non-Disclosure Agreements (NDA)

After sourcing a potential investment opportunity, the screening process begins with more thorough due diligence, such as a high-level analysis of the target company’s financials, market position, and growth potential.

Remember, deal sourcing usually means you have hundreds or potentially even thousands of investment opportunities to screen further. Set criteria and use screening questions to determine what opportunities are worth pursuing.

If the initial screening is positive, the firm signs an NDA to receive more detailed information about the target company.

Partners Review

After initial screening and due diligence, firms conduct a partner review. This is where the potential investment opportunities that have passed the initial screening and due diligence stages are further scrutinized by the senior members or partners of the VC firm.

An investment proposal and a First-Round Bid or Non-Binding Letter of Intent (LOI) will be drafted and reviewed. An investment proposal is essentially an outline of the deal’s key aspects, including the investment thesis, financial projections, and potential risks.

When a firm is interested in making an offer, a non-binding LOI gets submitted after the proposal. This includes the investors interest and proposed terms of the deal.

Research and Due Diligence

This step is a more detailed and in-depth in-depth analysis of the target company to validate the investment thesis and uncover any potential risks. It usually includes:

- Financial Due Diligence

- Legal and Regulatory Due Diligence

- Operational Due Diligence

- Competitive Analysis

- Final Due Diligence

Most investors begin with financials because they’re so important for valuing an investment opportunity. This includes analyzing the company’s financial statements, cash flow, and capital expenditure requirements.

Other areas, like the competitive landscape and legal implications, matter, too. For example, legal documents, contracts, and compliance with state and federal laws must be reviewed to identify any legal risks.

As the deciding factor or last step, investors conduct a final comprehensive review of all aspects of the target company, including site visits and meetings with key personnel.

Investment Committee

After final research and due diligence, the investment committee conducts a formal review and decision-making process by a group of senior partners or committee members who evaluate whether to proceed with an investment opportunity.

This final internal step includes preparing a detailed Preliminary Investment Memorandum (PIM). The PIM includes comprehensive results from the due diligence process, such as financial analysis, market assessment, risk evaluation, and the proposed investment structure.

Capital Deployment

Lastly, investors deploy capital to finalize the transaction. This includes the final binding bid, signing and closing the deal, and moving the funds. Once funds hit the company’s account, the deal is considered fully processed and the capital can be put to work.

8 Ways to Increase Deal Flow

We’ve discussed deal flow as a whole and how the process looks. Now, it’s time to get down to business and uncover eight ways to increase deal flow

1. Determine an Investment Thesis

Investors and firms find success with deal flow once they create and establish a clear investment thesis. It’s like niching down and targeting a specific sector, company type, or funding stage to differentiate yourself from others.

By defining your focus areas upfront, such as investing in SaaS startups at the Series A stage or cleantech companies in the seed/pre-seed stage, you can effectively filter and prioritize the deals that align with your criteria. A strong thesis includes:

- Sectors you will invest in

- Startup stage (Seed, Series A, etc.)

- How much you invest per deal

- Company location

- Company size

This strategic approach creates a tunnel vision effect that helps with positioning, networking, and authority down the road to maximize returns and deal flow.

2. Prioritize Your Networking Efforts

Building a network that generates regular inbound referrals is one of the best ways to maximize deal flow potential. Not only will you get new leads on autopilot, but there’s a higher likelihood the deal quality will be better.

According to a Harvard Business Review survey, 30% of deals are generated from former colleagues or work acquaintances. Meanwhile, another 28% of deals come from referrals by other investors and 8% from existing portfolio company referrals.

Trusted connections are more likely to refer high-quality deals, as their reputations are on the line. Strong networks of entrepreneurs, industry experts, and other investors can yield the best results for deal sourcing.

In the past, I’ve seen firms and investors have great success by solely focusing on their networking. The optimal network is full of:

- Portfolio company founders

- Co-investors or Leads

- Co-investors or Follows

- LPs

- EIR

- Angel investors

- Accelerators

I’ve quickly learned that, as an investor or entrepreneur, you can never have too big of a network.

Once you’ve set your investment thesis and the criteria you’re looking for in an investment opportunity, building a network becomes second nature.

3. Partner With Service Providers

Partnering up with professional service providers is another networking strategy for increasing deal flow. Investment banks, law firms, brokers, consulting firms, or any similar service-based business can create a steady flow of inbound leads that increase deal flow.

Getting referrals this way improves deal flow quality and the likelihood of a successful investment because referrals allow you to leverage your reputation. Right away, this helps you build better rapport and skip past the pre-screening stage.

4. Attend Pitch Events (Demo Days and Investor Conferences)

Since 2020 and the explosion of remote work, attending demo days and investor conferences has become easier than ever because of the shift to virtual hosting.

Although it’s much more difficult to establish rapport virtually than face-to-face interactions at in-person events, a mixed approach will generate the best deal flow results.

I’ve found the best deals to start in person and move online as we proceed. For example, meeting founders at a demo day and then conducting a remote pitch meeting in the future is a more efficient way to source deals.

5. Build an Online Presence With Thought Leadership Content

Becoming a thought leader in your niche or sector is a scalable method for increasing deal flow. This all ties back into establishing a clear investment thesis, as previously mentioned.

LinkedIn and X (Twitter) are two platforms that come to mind where investors can position themselves as industry leaders and maximize reach by sharing valuable insights, expertise, and personal anecdotes.

Once you develop niche expertise, new and more relevant deals will naturally gravitate towards you. Two examples of this strategy implemented successfully are Andreessen Horowitz and Y Combinator.

Both firms became powerhouses in their respective fields with consistent thought leadership on LinkedIn, X (Twitter), and through blogs.

6. Use Online Deal Platforms for Outbound Sourcing

Talking with investors, most prefer an inbound deal flow as their primary deal sourcing method. However, firms that rely too heavily on inbound are often left spending too much time on deal screening because lead quality is poor.

Outbound deal sourcing is even more important for smaller, less established firms and investors because they cannot rely as heavily on inbound deal flow as more well-known firms can. Proper outbound requires a strategy and the right tech stack.

To begin an outbound campaign, start searching for startups that fit your ideal customer profile (ICP) parameters and investment thesis on deal platforms like Crunchbase, Dealroom, and PitchBook.

Setting specific criteria is as important as any step when using a tool like Crunchbase. You can filter companies based on:

- Industry

- Funding stage, date, and amount

- Previous investors

- Location

- Signals (new leadership hires, growth insights, layoffs)

- Relevant keywords

Kai Fink, Principal @ GVC Partners, uses Crunchbase to search for potential outbound deals and investment opportunities. He states that you should be “getting as granular as possible” in your search parameters to find companies that fit your exact criteria.

7. Use AI To Automate Your Deal Flow Process

OpenAI and the release of ChatGPT are responsible for making AI mainstream. Less than two years later, it seems like there’s an AI tool for every task imaginable, such as finding acquisition targets, performing industry or competitor research, creating financial models, and conducting detailed startup analysis.

And believe it or not, the data suggests the use of generative AI in deal flow is still in its infancy. Today, only 16% of M&A deal processes use generative AI. Over the next three years, Bain & Company expects that figure to reach 80%.

Anybody implementing tools like Sourcescrub, Tracxn, and Cyndx into their deal flow process is still an early adopter. Because of GenAI, creating leads lists at scale or analyzing market trends and patterns has never been easier.

Invest in a Deal Flow Sourcing Partner

All the strategies we have discussed are surefire ways to maintain positive deal flow.

But one strategy that can outperform them all is a reliable deal flow sourcing partner who understands how to find off-market opportunities. This partner identifies, evaluates, and secures investment opportunities for business owners and investors in an off-market environment.

With the power of a sourcing service like Falcon River, you can increase your deal flow quantity and quality by:

- Finding highly targeted off-market deals that meet specific investment criteria.

- Automating deal flow screening to focus more on screen, due diligence, and capital deployment.

- Connecting you directly with business owners to streamline the deal process.

Plus, Falcon River works directly with sellers who want to exit their business. And unlike other brokers, Falcon River does not charge any fees to the seller.

By connecting sellers who have yet to list their business for sale with motivated buyers and investors, deals are filtered and sorted to ensure a higher success rate.

To learn more about how a deal flow sourcing partner works, schedule a demo today.