Deal flow management tools are the most time and cost-effective ways to track and manage acquisition deals for business aggregators and serial entrepreneurs.

In most cases, you’re actively searching for off-market online businesses that are ready to sell and align with your investment, portfolio, and growth goals.

Deal flow management tools make the entire lifecycle of sourcing, due diligence, and acquisition easier.

TL;DR

- Deal flow management tools help you and anyone you’re working with ⏤ deal-sourcing partners, suppliers, and business owners interested in selling ⏤ on the same page so that nothing gets overlooked during an acquisition.

- Deal flow tools function in similar ways to a CRM (customer relationship management), except with features and functionality aligned to the needs of entrepreneurs who are actively buying, growing, and selling (in time) a portfolio of online businesses.

- Because every deal is built on establishing trust and doing what you say, the more effective a tool at keeping you on track the quicker you can close deals with businesses that are aligned with your goals.

In this article, we take a closer look at deal flow management tools for business aggregators and serial entrepreneurs searching for off-market small businesses with the help of a trusted deal-flow sourcing partner.

Let’s dive in . . .

What Are Deal Flow Management Tools?

Deal flow management tools support entrepreneurs who are actively buying, growing, and selling (in time) a portfolio of online businesses.

For those looking to buy off-market software companies (SaaS), eCommerce, direct-to-consumer (DTC), apps, Shopify stores, franchises, Amazon stores, and niche websites, keeping track of every aspect of each deal can quickly get confusing.

It’s too easy to overlook an important document or message in a busy inbox. Even trying to track everything in an Excel or similar file doesn’t really solve the problem.

Attempting to use a CRM (customer relationship management), or other communication tools, such as Slack isn’t ideal, either. CRMs weren’t built for M&A, deal sourcing, or acquisitions. You could end up with a cobbled-together solution that just makes things more complex for you, your team, and business owners wanting to sell their businesses.

Instead, you need a dedicated deal flow management tool that’s built to handle the fast-paced complexities, security, and compliance requirements of business acquisitions and management.

We’ve put those on a separate list because PE firms have somewhat different needs than entrepreneurs and business aggregators when it comes to M&A, so we’ve sourced tools that are more suitable to those requirements.

What are The Top 5 Challenges Deal Flow Management Tools Help Solve?

Here are the five ways deal flow management tools solve serious headaches for entrepreneurs and investors who are actively buying businesses.

Deal Sourcing

Deal sourcing, also known as deal origination, is one of the biggest challenges in this line of work.

With an effective deal flow tool, you can:

- Aggregate dozens of sources of information into a single dashboard.

- Keep every inbound deal flow referral and recommendation in a CRM-style system so they don’t get lost in your inbox, Slack, or other communication channels.

- Record every new potential deal and categorize/tag them according to filters you establish, such as the type of company, deal size, market, and other ways of recording the data.

Looking for a reliable deal-sourcing partner for off-market deals?

Work with Falcon River when you’re searching for new off-market acquisition deals.

Deal Pipeline Management

Once you’ve got an active pipeline of deals to manage, you need to track every phase of every deal individually. Having this easy-to-organize overview will give you peace of mind and save time.

Instead of trying to remember whether you’ve started due diligence with one company while you’re initiating a conversation with another, everything will be carefully recorded and automatically logged.

With a deal pipeline management solution doing the mundane but hard work, you can focus on what really matters: relationships.

Your work shouldn’t be consumed with admin and due diligence. Your time is better spent talking to the business owners who want to sell to evaluate whether they’re a good fit. Use this information to assess whether and how you can add value post-acquisition to grow the value of that business and sell it for more down the road.

Capital Fundraising

Serial entrepreneurs, investors, and business aggregators normally have to raise funds when they’re looking to buy several or dozens of businesses. You want to build and grow a portfolio, and then sell your acquisitions when they’ve scaled for even larger multiples than the purchase price.

So, this means you need investors to join your portfolio fund. Securing investors takes as much if not more work than buying the right businesses. Wouldn’t it be great to de-risk and reduce the complexity of both tasks by keeping every relationship in one software app?

With the right deal flow management tool, you can do that. Create separate areas for investors and business owners (acquisition targets), so that you can manage everything in one dashboard. No more email overload!

It’s also useful to know which businesses have been approved for seller-financed SBA-guaranteed loans (Small Business Association), as this makes an acquisition more affordable. You can use this as a selling point to investors, further de-risking their investments and increasing the portfolio value.

Due Diligence

Due diligence is a complex process. It’s a checklist in many ways, but it’s a two-sided one. It involves people completing time-consuming tasks, doing them well and with care, and both parties need to drive it forward ⏤ the buyer and seller.

When working with us to source acquisition deals, we encourage sellers to have everything ready to accelerate this process, including:

- Sale-ready accounts, including current cashflow, cash-on-hand, P&L, balance sheet, and receivables.

- Bank statements and projections are often needed to show Discounted cash flow (DCF).

- An NDA, a Confidential Information Memorandum (CIM), and a Letter of Intent (LOI.

- Documents and evidence outlining what the business does, revenue streams, staff, suppliers, vendors, customers, any intellectual property (IP), and future growth opportunities.

- Confirmation that the business is pre-qualified for a seller-financed SBA-guaranteed loan.

- A realistic valuation ⏤ potentially one prepared by a professional valuation analyst ⏤ that factors in revenues (MRR, ARR, retention rates/churn, the size of the market, etc.), assets, liabilities, EBITDA, and discounted cash flow.

- Comparable valuations for businesses doing similar revenue and profit numbers in the same sector.

- Anything else that will help a potential buyer assess the value of a business, and crucially, its post-purchase growth potential.

As a potential buyer, if you can see they’ve delivered everything, then you can have your team (including a lawyer, accountant, and any finance professionals or partners) review the documents.

Keep track of everything you expect a potential acquisition target to deliver, and then use the deal flow management tool to track responses and actions you need to take.

Manage Your Business Portfolio

Once you’ve bought an off-market online business, the aim is to grow it over the next few years until you can sell it for a much larger amount. You may have specific targets to hit with each asset to provide an agreed return to investors.

With a deal flow management tool, you can track asset performance, and manage every aspect of that business’s operations and finances. You can track:

- Current revenues (MRR, ARR, EBITDA, etc.);

- Team performance and KPIs;

- Any inputs and investments you’ve made to accelerate growth;

- The outcomes from those investments include added-value revenue growth.

5 Best Deal Flow Management Tools

Here are 5 of the best deal flow management tools on the market.

Attio

Attio is a deal management solution formerly known as Fundstack.

Top Features

- A customizable CRM toolkit and platform.

- Can be configured for almost any business need, including M&A deal flows and investments.

- Lots of integrations and features for relationship management.

Pros

- It also has Android and iOS apps, plus Gmail and LinkedIn extensions.

- Highly secure and great for data imports from other software like Salesforce.

Cons

- Although it’s a SaaS tool, it’s designed to be customizable, so you might prefer something that’s out of the box and ready-to-use.

- It’s not designed specifically for entrepreneurs and businesses that buy businesses, except for its earlier iteration as Fundstack, when it was more VC-focused. Might not be completely suitable for your needs.

Pricing: A free plan is available (for up to 3 people, with limited features), with a Pro plan from $39 per user/month.

Affinity

Affinity is a relationship intelligence platform for dealmakers.

Top Features

- Two core products built on the same principles: Affinity CRM and Affinity for Salesforce.

- Provides investors with more data to find and close better deals.

- Features that support investment fund and portfolio management.

Pros

- Lots of integrations and solutions that help entrepreneurs and business aggregators conduct M&A deals.

- Advanced AI-powered functionality and improved data collection.

Cons

- People encounter some workflow issues from time to time.

- Lacks more powerful calculation features that would be useful, like Excel.

Pricing: From $2000 per user/annually.

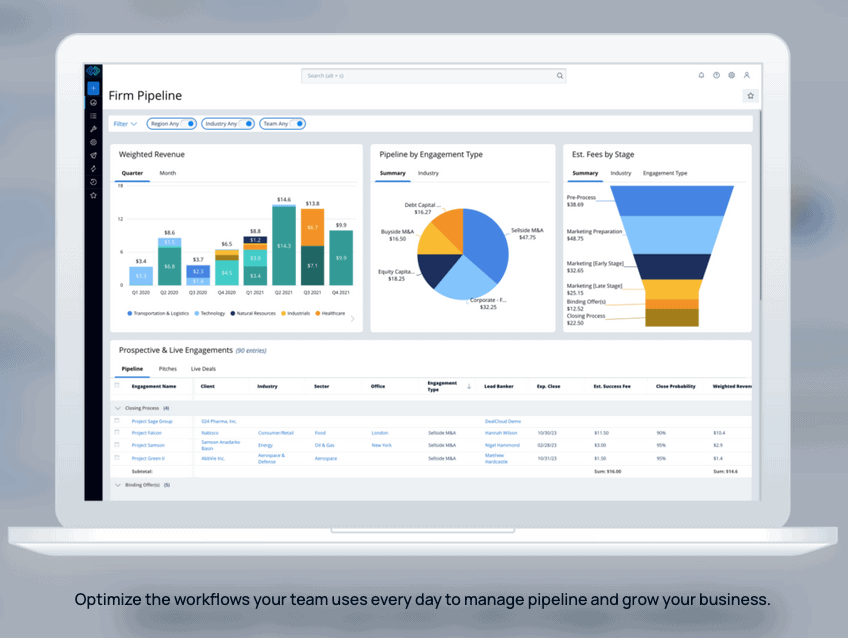

DealCloud

DealCloud is on another list of SaaS tools that are suitable for PE firms too because it’s got enough to recommend it for PE and serial entrepreneurs or business aggregators.

Top Features

- Intapp DealCloud is a powerful CRM for buyers and investors in businesses.

- Great for managing your deal flow and deal origination.

- It also comes with AI-powered features for tracking and forecasting your pipeline.

Pros

- Intapp Assist for DealCloud (AI) is useful for improving your deal flow knowledge and workflows.

- Various Microsoft plug-ins and add-ons make this useful for firms that use Microsoft.

Cons

- A very large suite of tools and features: could be more powerful than you need.

- Over-complex workflows, although if you’ve got 100s and deals and investors then this could be the one for you.

Pricing: Customized pricing for every customer.

Navatar Edge

Navatar Edge is a CRM built for private finance, equity, and entrepreneurs in M&A.

Top Features

- Designed on top of Salesforce with features built specifically for private finance in every shape and form.

- Deal flow intelligence is built into the platform, to help buyers of businesses “connect the dots to arm you with intelligence that can be a game-changer in dealmaking.”

- A mobile app that makes it easier to have the information you need in face-to-face meetings.

Pros

- Several useful functions and features as this is based on Salesforce.

- Capable of serving a wide range of financial sectors and markets.

Cons

- It promises to help entrepreneurs using it to “bring their A-game” but is light on details as to how this software helps you achieve that.

- An out-of-date user experience and other tools have more powerful functionality.

Pricing: Customized pricing for every customer.

4Degrees

4Degrees is a CRM trusted by 100s of teams in private capital markets financing.

Top Features

- A relationship intelligence-based CRM built by former investors (VCs).

- Built-in relationship intelligence that can unlock over 4,000 signals in your network that could go unnoticed and lead to new deal opportunities.

- Alerts for when people in your network move jobs or make other important changes.

Pros

- An investor-driven CRM that pulls in data from third-party sources (Crunchbase, Pitchbook, etc).

- Plugs-into email (Gmail), LinkedIn, and other tools you’re already using so you don’t need to keep switching tabs and apps.

Cons

- A somewhat clunky user experience.

- Difficult to create the right tags for deals, deal stages, and other information required within a deal flow.

Pricing: Customized pricing for every customer, on a per-user per-month model.

Key Takeaways: Why Deal Flow Management Tools Are An Asset in M&A?

Although we can’t recommend a specific tool, we know your team would benefit from one that:

- Make deal sourcing and deal origination easier and more effective to track every new deal in the pipeline;

- Support deal flow pipeline management, making you more efficient and organized;

- Helps you manage every aspect of due diligence, fundraising, and portfolio management.

We also recommend working with a deal-sourcing partner who will send purchase-ready acquisition targets that are the best fit for your firm.

Work with Falcon River when you’re searching for new off-market acquisition deals.