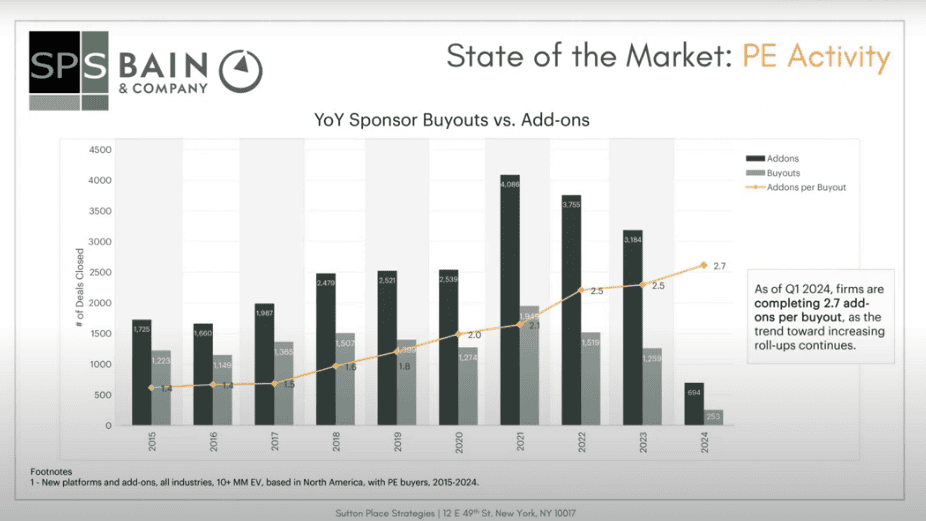

Add-on acquisitions at private equity-backed companies are on the rise. As of Q1 2024, firms are completing 2.7 add-ons per buyout.

Why are private equity firms leaning on add-on acquisitions? Add-on acquisitions or the “buy-and-build strategy” generate high returns for their limited partners (LPs). In the buy-and-build strategy, a PE firm will acquire a platform company that is stable and growing. Then, PE firms will source multiple, smaller acquisitions (typically valued at a lower valuation) in the platform company’s same industry or complementary industry.

The reason the buy-and-build strategy is becoming more popular is because once an add-on company is acquired, their revenue becomes valued the same as the original platform company’s multiple. PE firms have a limited window to generate a higher valuation for their portfolio companies and add-on acquisitions are a cost-effective way to increase their funds’ returns.

What is a PE Add-on Acquisition?

An add-on acquisition is when a private equity firm acquires a company and integrates the smaller target company into one of its larger portfolio companies.

Add-on acquisitions are a part of the buy-and-build strategy. Buy and build is a common strategy where private equity firms increase a platform company’s valuation by acquiring one or more smaller targets. The goal is to increase the value of the platform company and most importantly, the firm’s return on investment after the length of their investment period (typically around 7-10 years).

A typical private equity deal is structured as a leveraged buyouts (LBOs). LBOs are when a private equity firm purchases a company with a significant amount of borrowed capital. Similar to a homeowner using a bank loan to purchase a house, PE firms use borrowed capital to acquire companies, build value throughout their investment period and then sell at a higher valuation.

Private equity firms can increase the value of a portfolio company much more quickly by acquiring a smaller target company to fold into the existing platform company.

There is a lot of terminology around the buy and build private equity strategy. But there are two important distinctions when it comes to add-on acquisitions. PE firms can use the bolt-on or the tuck-in acquisition strategy.

The two types of add-on acquisitions:

- Bolt-in acquisitions– add-on companies that are purchased by a platform company, but they still exist and operate under their own name.

- Roll-up or tuck-in companies – add-on acquisitions that are absorbed into the larger portfolio company

The bolt-on acquisition strategy, where a smaller company is acquired but maintains its unique identity within the larger parent company, may be most useful when brand recognition is a key reason for the acquisition. For companies where the brand name is not as well known, PE firms may choose the roll-up or tuck-in strategy where the smaller target company is absorbed into the larger portfolio company.

Buy and Build Strategies are on the Rise

Since 2021, there have been more than double the add-on deals than platform deals across all M&A transactions.

These numbers line up with the rise of buy-and-build strategies for PE firms in multiple industries. For every PE platform company purchased, there will be one or more add-on acquisitions to bolster the company’s bottom line and PE firms’ returns.

The add-on acquisition strategy relies on arbitrage.

Arbitrage is the strategy of combining multiple smaller companies to drive a higher selling price in the future. It’s riskier for a PE firm to acquire several, lower valuation companies than to purchase one stable, growing company and add products through inorganic growth.

With the trend of add-on acquisition consistently growing, is there an oversaturation or slowdown in sight for the remainder of 2024?

Not likely.

According to EY, 52% of US CEOs plan to engage in M&A in the next 12 months. Add-on acquisitions will continue to be a level for PE firms to use in 2024 and beyond because of the speed at which add-on acquisitions allow platform companies to grow.

Perks of Add-on Acquisitions

Private equity firms pursue add-on acquisitions for a variety of reasons, but the 3 most common perks of add-on acquisitions are to acquire new talent, offer new products, or add new customers.

Acquire New Talent

Add-on acquisitions help platform companies acquire new talent. A larger platform company backed by private equity may pursue add-on M&A to increase their talent pool. Depending on the size of the company, the platform company could potentially hire hundreds of people with the closing one deal. These employees may have an expertise in a new technology, they may have expertise in a different industry than the platform company, or the company may have the right quantity of workers to help the platform company hit their growth targets.

Offer New Products

Add-on acquisitions help platform companies offer new products. To grow and build a more valuable company, a portfolio company may target a company that has a wider product offering for their industry and clients. The portfolio company may look to smaller companies to add new features to an existing product or completely new product lines.

Add New Customers

Add-on acquisitions help platform companies add new customers. One of the fastest ways to increase a company’s customers is to purchase competitors or complimentary companies in the space. All add-on acquisitions should result in higher revenue for the platform company either through 1) opportunities for new customers (or increased contracts with current customers) or 2) an immediate base of customers to cross-sell two product offerings.

Sourcing Add-on Opportunities

PE firms looking to acquire add-on acquisitions for a portfolio company should approach these deals with similar deal sourcing strategies as they would a platform deal.

In order to uncover all the possible opportunities, firms should use multiple channels like manually finding companies through Google or LinkedIn, using company databases or deal sourcing platforms, and partnering with bankers and advisors to find the right targets.

But PE firms have a huge, additional resource when it comes to add-on acquisitions: the platform company’s team.One of the best ways to begin sourcing add-on deals is to listen to the team at the portfolio company. Sales reps, product leads, customer service teams will have their ear to ground and know who the competition is and the products or services that their clients are already using in tandem with the current offering.

PE firms that listen to their portfolio companies’ executive teams will uncover a gold mine of possible acquisitions.

Add-on Acquisition Examples

Private company acquisitions often do not get the same news coverage as public company acquisitions. PE-backed companies are more hush hush about acquiring companies for talent or products, but there are resources to find more information about ongoing private market M&A. For example, Fortune’s private market newsletter “Term Sheet” covers a daily roundup of M&A activity.

One example of a private market add-on acquisition is the $4.6 billion acquisition of Diversity Holdings by Solenis– a Platinum Equity portfolio company – in 2021. This acquisition enabled cross selling opportunities from two companies with adjacent offerings resulting in new products and new customers for Solenis.

There is more analysis available for the strategies and conversations leading up to public company acquisitions. Though the following examples are not private equity backed companies, they are tangible examples of company inorganic growth through M&A.

Another inorganic growth examples include:

New Talent Pool

In the 2023 race to AI, Apple led the charge in early 2024 by acquiring 23 AI startups. They acquired both the technology of these companies, but also their engineers. Rather than going head to head with AI engineers at other companies, Apple doubled down and bet on the AI teams of multiple startups.

New Technology

In 2016, Facebook acquired Oculus for $19 billion. This acquisition rapidly accelerated Facebook, now Meta’s, ability to launch their virtual world in 2021. The success of this launch is debatable, but the launch and subsequent product advances would not have been possible without the acquisition of in 2016.

New Clients (Cross-selling)

In 2019, Microsoft acquired LinkedIn. With this acquisition, Microsoft not only gained access to LinkedIn’s ad revenue, but more importantly its company and employee data. The companies’ synergies may not have been obvious at first, but the $26 billion deal paid off. Within 3 years, LinkedIn’s user base more than doubled.

Private equity firms that think outside the box when it comes to company synergies can reap the benefits, but there can be roadblocks to achieving those high returns. There are strategies that PE firms should keep in mind to make sure an add-on acquisitions successfully integrate with a platform company.

4 Key Ingredients for Add-on Acquisition Success

Add-on acquisitions are not a surefire way to increase the platform company’s valuation.

If this is misalignment in product offerings, combining two or more companies can have more negative impacts than positive.

Mckinsey & Company recommends these 4 practices for any PE firm considering the add-on strategy:

1) Accelerate decision making. “The most effective deal and operations teams in PE firms use a focus on value creation to overcome secondary and distracting objectives.”

2) Ensure rigor. “Establish an apples-to-apples financial and full-time-equivalent baseline to understand exactly how each company has classified its employees and functions so that they can be correctly compared.”

3) Secure talent. Classify employee talent into 3 levels: mission-critical talent, high-potential talent, and value-creating talent. Make specific plans to retain each category.

4) Most importantly, align on the goals. – “A shared mission focused on a deal’s full potential is the glue that will make partnerships sustainable across the PE firm and the portfolio company’s management team.”

With add-on acquisitions on the rise, PE firms need the right partners to secure strong deal flow for their platform companies.

If you’re looking to bolster your platform company with add-on acquisitions, look no further than Falcon River. Falcon River is the best-in-class dealflow service that connects qualified buyers and sellers.

We are investing in proprietary IP that connects you with the right targets, fast. Set up a meeting to learn more.

FAQs

Private equity firms pursue add-on acquisitions for a variety of reasons, but a good add-on acquisition accomplishes one or more of these goals: the add-on acquisition should help the platform company acquire new talent, offer new products, or add new customers.

In private equity, the buy-and-build strategy starts with the purchase of 1 platform deal. Once the platform company is acquired, the PE firms can pursue add-on acquisitions that (typically) are valued at a lower valuation. The standard add-on acquisition will be an accretive, meaning that any revenue from the add-on (or target company) will be valued at the same multiple as the platform company.

While each industry is unique, PE firms are looking to acquire new talent, new products, and ultimately new customers with each add-on acquisition.

Answer: One of the best ways to begin sourcing add-on deals is to listen to the team at your portfolio company. Sales reps, product leads, customer service teams will have their ear to ground and know who the competition is and even products or services that your clients are already using in tandem with the current offering.

Another method is through your current deal sourcing channels whether it be through an in-house deal origination team or intermediaries, set your criteria, and get to work finding the under the radar companies that fit your inorganic growth plan.

PE-backed company acquisitions are not as well-publicized as public company acquisitions. Typically, private company acquisition will not be featured in major news headlines but there are resources, like Fortune’s private market newsletter called “Term Sheet” that round-up daily M&A activities in private markets.

One example of a PE add-on acquisition was the $4.6 billion acquisition of Diversity Holdings by Solenis– a Platinum Equity portfolio company – in 2021. This acquisition enabled cross selling opportunities from two companies with adjacent offerings resulting in new products and new customers for Solenis.