2024 promises to be a lucrative year for mergers and acquisitions (M&A). Without the right tools and technology, deal flow slows down. Automated deal flow process finds the right targets, faster.

From deal sourcing to due diligence, deal flow automation helps get the best opportunities into your pipeline. Improve your response times, optimize your strengths, and land the best deal on the market.

Why Automate Deal Flow?

2024 is a great year to rethink your pipeline and start automating tasks.

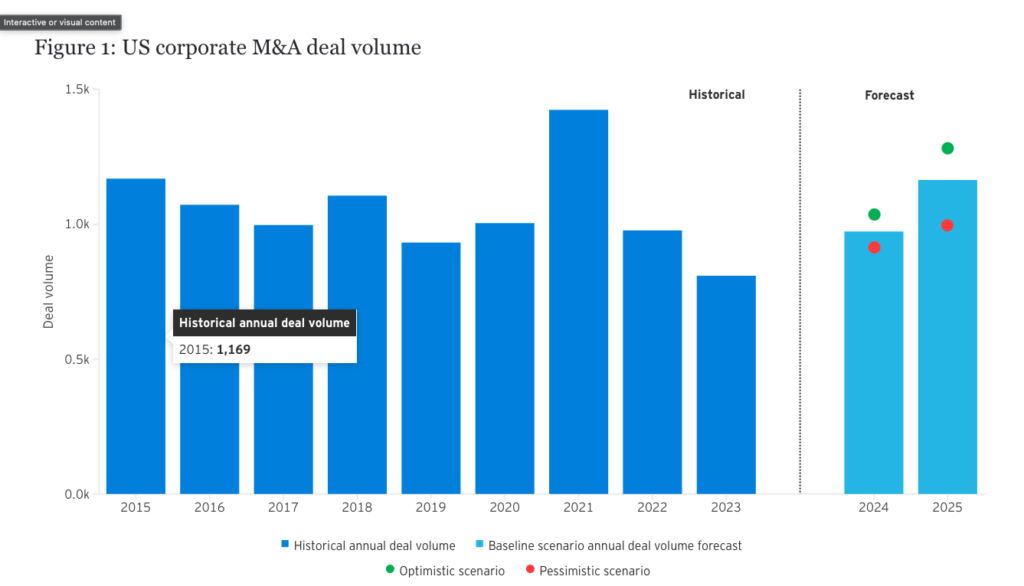

In addition to new technology – we’ll get to AI in a minute – Mckinsey’s latest report encourages dealmakers to be prepared for an uptick in M&A in 2024 and 2025. The best way to do this? “Re-evaluate M&A themes and update strategy, invest in capabilities and assets that will effectively evolve the portfolio, and consider divestitures as actively as acquisitions.”

The good news: It’s going to be a busy year in M&A.

The EY Deal Barometer suggests that in an optimistic forecast of 2024 and 2025, the number of deals will increase 31%, and if the recovery is slower, the growth will still be around 13%

The bad news: dealmakers who do not lean on technology and automate their processes will fall behind.

If you’re looking to join the upswing of M&A and acquire new businesses, you need better systems in place– but there are some problems standing in your way.

Low-quality business opportunities. Oftentimes, you waste time in the deal flow process courting the wrong businesses. Researching and approaching businesses takes hours of work, and it can be frustrating to find that those hours were wasted on a business that does not fit your criteria.

Stiff competition. For businesses that are high quality and worth pursuing, another problem arises: competition. Without early access, you’re left waiting in line for a company that is likely already to be sold by the time you get a foot in the door. The best deals will likely be off the market as soon as they are listed.

Disjointed data sources. Even the best M&A professionals run into the problem of disjointed data sources. Without one source of truth they are likely to miss new opportunities, miss opportunities for follow-ups with potential business owners, and ultimately miss out on deals.

When acquiring businesses, time is your most valuable asset. How you spend it could lead to the right deals or not. That’s why it’s important for dealmakers to automate deal flow in ways that best fit their goals and processes.

Here are some ways to sharpen your M&A procedures so you don’t fall behind in the coming M&A resurgence.

How to Automate Deal Sourcing

The first step in the deal pipeline is deal sourcing. Even though this is the first step, you luckily do not need to start from scratch. You can lean on any past deals to guide your company criteria.

Things to consider from your previous successful deals:

- Company size

- Company client/audience

- Company location

- Industry

- Offering

Evaluate what was most successful, and let that inform your investment thesis.

For those looking to land their first deal who are just getting started in M&A, you may not have a past deal to go off of, but you will have an ideal company profile and investment thesis in mind. Closely define the company characteristics you’re looking for, but also be willing to expand beyond those outlines to find the best fit.

Once you’ve set the criteria you’re looking for in an acquisition, it’s time to automate some steps.

Use bankers and brokers to ease the lift. Bankers and business brokers are resources to find you the right deal at the right time. On your own, you may find long lists of companies to acquire that are not looking to sell. You may find the perfect company to purchase, but they are not in the market. Offloading deal sourcing tasks, eliminates the problem of approaching companies that are not on the market.

Instead of thousands of emails to individual companies, you’re responsible to check in with one point of contact doing the heavy lifting for you. Leaning on a broker means that your time can be spent researching and further defining your investment thesis.

When evaluating a potential deal sourcing partner, you need to make sure you’re partnering with the right firm. A great place to start is by asking if they have experience in the industry you’re looking to acquire.

If the answer is yes, the banker/broker will be much more successful finding you the right companies to look at. If the answer is no, they will likely be starting from scratch, wasting your time.

Another question to ask a business broker: what is your competitive advantage? What makes sellers use you out of all the possible options out there?

The answer should be more compelling than “just trust us.”

For example, the Falcon River team has acquired, owned, and operated online businesses for over 18 years. Though we worked with brokerages, they only occasionally found a business through those channels. The problem wasn’t with the brokers or brokerages, it was in the structure. Brokerages are inherently a seller based system. That’s why we decided to develop a new structure that puts buyers in the driver’s seat and eliminates the fees for sellers.

Build internal M&A automations. If you decide not to partner with a broker or decide to simultaneously source proprietary deals, you will need to build the processes that automate your deal sourcing.

Deal sourcing is a numbers game. For every thousand companies you contact, you’ll likely get one meeting. So you’ll need to incorporate deal sourcing tools into your tech stack to accommodate this kind of scale.

In addition to asking about fees, here are some questions to consider when evaluating deal sourcing technology:

- Do they have company data in your target industry, location, size, etc?

- Can you contact companies directly within the software?

- Can they provide case studies where firms using their platform landed deals?

- What is the setup process? How long will it take to incorporate this new technology into your current deal sourcing workflow?

You may be asking, “Do I need to buy yet another tool to automate the deal sourcing process at my firm?”

It is possible to manually sort your data.

Edsul Guzman goes into detail about the Excel algorithms needed to build a homeground database, but it’s important to note that without deep excel knowledge or IT buy-in, the time you put into these types of automations will have diminishing returns.

There are many routes when it comes to automating the deal sourcing step in the deal flow pipeline. You can keep everything in-house, buy or build the technology needed to sift through millions of companies, you can lean on brokers and their expertise to bring deals directly to you, or some combination of the two that best fits your M&A needs.

How to Automate Network Check-ins

A tedious step in the deal flow pipeline are the routine check-ins with business owners, bankers and fellow investors. This is the nurture phase and it’s important because it maintains the relationships that may know about your next deal.

But it’s also time consuming.

You need to prioritize these conversations but you need to do so in a scalable way.

Automating check-ins begins by creating audience segments. These lists can include CEOs of companies you’re looking to acquire, bankers, anyone you want to keep in contact with on a recurring basis. Likely these different segments will have slightly different messages, but can both be put into sequences to make sure your name is staying top of mind throughout the year.

There are many options when it comes to which email sending service you use. Tools like Apollo are best for cold outreach sequences – people who are not yet in your rolodex but you would like to be. Platforms like Mailchimp or Behiiv are best for creating newsletter lists.

Regardless of which tool you use to send mass emails, you should create a subdomain to protect your email deliverability.

Sending mass emails accomplishes a few goals: 1) It keeps your name and your firm top of mind, 2) it establishes you as a trusted voice in your industry which can set you apart from other firms.

You and your team already spend hours researching your industry/s, talking with business owners, etc. Why not use that experience to leverage your next deal?

Your emails can include:

- New deals you’ve landed

- Research you’ve conducted

- Businesses best practices

- Industry interviews

Gmail alone cannot handle this level of outbound. You will need to incorporate a separate tool to send emails in batches and to set up automated sequences.

Why Automate your Outbound Communication?

In order to land 1 deal, you’ll likely need to have thousands of conversations. It’s not possible to have hundreds of personalized conversations at scale each week. By creating audience lists and customized sequences you’ll be adding a personal touchpoint with prospective businesses without sinking hours into individual email outreach.

This step is still one that most dealmakers skip in the process. Don’t forget to stay top of mind to businesses and brokers. Stand out from the crowded marketplace by staying in people’s inboxes on a regular cadence.

How to Automate Due Diligence

Every deal is different. You can be prepared and have procedures, and still experience a unique timeline for each deal. Regardless, they are elements of the due diligence process that can be prepped and ready to execute the minute a deal becomes available.

The most important step in automating the due diligence process: have your document requests ready to send. The list of required documents will vary, but will always include, articles of incorporation, DBAs and all names of the subsidiary companies, federal, state, and local tax filings, copyrights, trademarks and other intellectual property. Bloomberg Law lists each item that you could request from the business during due diligence.

The due diligence process is still a manual step in the deal flow process, but here are some ways to speed up the process.

Have a single source of truth. Pick a secured location where all of the business’ documents live. Due diligence delays usually result from disorganization. Avoid the confusion of team members working on outdated contracts, sending multiple emails asking where documents live, and other time consuming tasks by clearing laying out a system from the start.

Identify and streamline communication. Another way to optimize due diligence is by identifying project owners and points of contact for each step of the process. Clearly identify who will answer legal questions, operations questions, financial questions, etc.

Use a project tracker. Make sure everyone is aware of where the process is at and what the blockers are. A project tracker is essential to getting everyone in the loop. The project tracker could be as simple as a shared Google sheet or more complex with project management tools like Monday, Asana, or Notion.

Due diligence is the most manual part of the deal flow pipeline. There’s no way to automate legal questions that come in at all hours of the day, but you can create a checklist and systems that keep the process moving.

What Artificial Intelligence Means for Deal Flow Automation

AI is changing every industry and M&A is no exception. Whether it’s AI identifying investment opportunities at the deal sourcing stage, generative AI writing emails to executives, or identifying discrepancies in due diligence documents, AI is an invaluable resource when it comes to automating dealflow.

AI in Deal Sourcing

AI provides a much easier, faster way to dissect huge data sets. Dealmakers who employee AI to create a proprietary edge will be the ones faster to the best deals.

Depending on your needs, you can purchase tech, lean on your bankers, or build your own in-house technology. Building your own proprietary data warehouse only makes sense for serial acquirers in private equity and venture capital with in-house expertise.

For all others, employing technology on a smaller scale, purchasing a subscription or relying on your advisor’s proprietary technology makes the most sense.

AI in Communications

Generative AI can write personalized followup sequences to business executives. Crafting a template is easy. You can plug specific value adds into a tool like a ChatGPT which creates grammatically correct emails in seconds, not minutes.

AI in Due Diligence

AI is also disrupting the due diligence process.

According to EY, AI is able to detect incongruent information on different due diligence documents. “The annual report mentions that the target has sold a real estate property in FY 2022. AI can pick this up autonomously and check whether all the documentation that is common in connection with such a sale is available. In seconds, the software could flag a missing notarial deed or a tax declaration where the purchase price does not match the amounts in the financial statements.”

AI improvements are moving at such a clip that the list of the tasks it can accomplish will be longer in a month. For now, the best way to incorporate AI into your deal flow is to stay up to date and only incorporate the tools that make the biggest impact on your pipeline.

Find the Right Partners, Find the Right Deals

The future of M&A will include more technology, but the competition for the right deals will not diminish. That’s why you still need to invest in the right partnerships.

If you’re looking to automate deal flow, look no further than Falcon River. Falcon River is the best-in-class dealflow service that connects qualified buyers and sellers. We are investing in proprietary IP that connects you with the right targets, fast.

Set up a meeting to learn more.