When you sell a business privately it means you’ve done it “off-market.” Instead of promoting the fact you’re selling online, you’ve chosen to go the private sale route.

In this article, we look at the steps you need to take to sell a business privately, with insights from business owners who’ve been-there-done-that.

TL;DR:

- Selling a business privately is easier, in many ways, than selling publicly.

- A private sale reduces time-wasters, tire-kickers, and competitors wanting to get a look at the details of your business.

- In order to sell successfully through a private sale you need to get organized, and it can save time to work with an off-market business sourcing and M&A partner.

Let’s dive in . . .

Why Sell a Business Privately?

One of the main reasons to sell privately is that when business owners go public with details of their plans to sell it usually leads to the following:

- Lots of time-wasters;

- Too many tire-kickers;

- Competitors want to get a look at the details of your business.

It also leads to this kind of scenario:

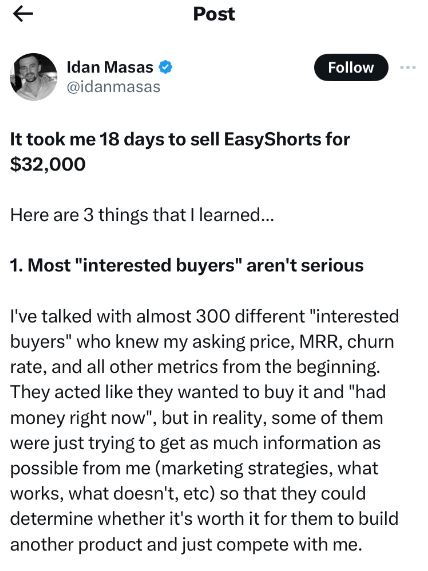

As Idan Masas, founder of EasyShorts said on X:

“I’ve talked with almost 300 different “interested buyers” … [who] “had money right now.”

Yet, when it came down to whether they were genuinely serious and “had money” to buy, they didn’t.

Serious buyers know exactly what they want, and how it aligns with their investment criteria, and are ready to make a purchase fast.

Promoting your business for sale online could open the floodgates for those who simply want to take a closer look, promise the world, and waste your time.

Alongside those risks, there are others:

- Current customers might lose confidence in your business and go elsewhere if they’re worried you won’t be around much longer;

- Potential new customers will do the same;

- An online ⏤ sale such as through numerous M&A platforms and social networks ⏤ can pull your focus away from running your business;

- If current growth rate and operations are compromised because you can’t focus, that could actually harm the sale value of the business.

This is why selling a business privately makes a lot of sense compared to selling it publicly, online, and through M&A platforms.

What Types of Businesses Sell Privately?

You might be wondering, “Can I sell my business privately?”

The simple answer is, that anyone can sell their business privately. Unless, of course, your business is already publicly traded. In that scenario, there are rules governed by the Securities and Exchange Commission (SEC).

However, for the vast majority of private business owners ⏤ even if you have shareholders/investors ⏤ you can sell your business privately.

Here are the types of businesses we have experience helping to sell privately, off-market, to purchase-ready buyers:

- Niche websites

- Online marketplaces

- eCommerce

- Software as a Service (SaaS)

- Newsletters

- Podcasts

- Direct to Consumer (DTC)

- B2B or B2C apps

- And any other online businesses that are ready to sell.

Before we look at how to sell a business privately, let’s weigh up the pros and cons of both options: a private sale vs. a public exit.

Pros and Cons of Selling a Business Privately

Pros of Selling Privately

We recommend going to the private sale route. Here are a few of the advantages of that approach:

- You’ve got a better chance of only engaging with serious potential buyers;

- You can narrow your exit opportunity pool, and that can be an advantage when you’re still running your business;

- Fewer time-wasters and tire-kickers;

- Less chance of competitors taking a closer look at your business to determine whether they can replicate it;

- A better chance of getting a serious buyer faster than other methods: online M&A platforms, advertising it on social networks, and even brokers who advertise it online.

Cons of Selling Privately

At the same time, there are a few disadvantages to consider:

- If you’ve got a large audience/network, this approach might reduce the number of potential buyers;

- A large strategic buyer might not realize your business is for sale unless you contact them directly (or have someone do that for you);

- If you’ve got processes, systems, or even someone helping you with the sale then a large influx of potential buyers might not be as difficult to handle.

Now, let’s look at 5 ways to sell your business privately.

5 Ways to Sell a Business Privately

1. Make a List of Potential Buyers

You could be surprised where you find a potential buyer for your business.

Start within your network. Make a list of:

- Suppliers and partners (up and down the value chain);

- Competitors of every size;

- Businesses that complement but don’t compete with yours (e.g., an SEO agency could buy a social media or video agency);

- “Big names”, such as serial entrepreneurs in your network;

- Business aggregators that buy numerous companies within a portfolio model and grow them;

- Groups of serial entrepreneurs, also known as investor syndicates.

There’s a good chance you could find this list from:

- LinkedIn connections;

- A newsletter database;

- Your customer relationship management (CRM) software;

- Business connections and friends in the real world;

- People you follow on other social networks, such as Twitter/X.

For more information about how to make your business sale-ready, here’s our article on: “How to Find a Buyer for Your Business.”

2. Put Together a Sale Pitch Pack

A sale pitch deck is a useful tool when selling a business. Think of it like a B2B sales pitch deck, advertising products or services to potential customers. Except this is for selling your business privately.

Having a sales pitch deck should cover the basics when looking for a private buyer:

- Current revenues (MRR, ARR)

- Profitability (Discounted cash flow (DCF) and EBITDA)

- Cash-on-hand and current receivables

- P&L and the balance sheet

- Future growth potential

- Anything else that makes your business an attractive acquisition target

You never know when you might need a sales pitch deck.

In the case of Mark Whitman, the founder of Contentellect, when one of the Onfolio team contacted him out of the blue.

The good thing is, that he was actively looking privately for a buyer.

Onfolio was already aware of Contentellect when they were scouting for more businesses to buy. Mark’s activity marketing his agency to win new clients was enough to bring inbound acquisition offers.

After a bit of back-and-forth, Contentellect sold for “$850,000 in cash.

I received a higher offer that involved an earn-out, but I was looking for a cleaner, faster sale and was willing to accept a lower purchase price.”

3. Reach Out to Those Contacts

Let’s get started with the DIY approach to selling your business privately.

- Have your list of potential buyers ready in a spreadsheet, CRM, or another tool;

- Have an introductory email ready;

- Have your sale pitch deck ready;

- Have one or two follow-up emails ready (not as many as a sales outreach sequence, as you’re asking them to buy a business rather than something with a much lower ticket value);

- Now, it’s go time! Start contacting potential buyers of your business privately.

Like with any cold outreach, a quick response indicates they’re potentially interested.

Not hearing back from them is a sign they’re definitely not interested.

💡Pro Tip: If you don’t know someone well enough for a cold outreach, do you know anyone who knows them who can make an introduction?

Introductions can go a long way. All it takes is one person in your network to turn a cold outreach into a warm introduction.

Work out various connection points between you and the potential buyers you want to reach.

Make a judgment call as to whether an intro would make that ask warmer. If the answer’s yes, then review your connections to see who could make that introduction on your behalf.

4. Extend Your Reach Via Newsletters and LinkedIn Connections

It’s always useful to extend your reach if you want to get extra options in the business exit pipeline.

Ways to do this could include LinkedIn and newsletters.

If you work with or know companies that have large newsletter databases, you could ask for an anonymized summary of your sale information to go into them.

When you don’t have the email address of a potential buyer (or someone who can make a warm introduction), it’s always worth sending a LinkedIn direct message.

5. Work With an Off-market Business Sourcing and M&A Partner

All of that might sound like a lot of work. You’ve still got a business to run and keep growing and going until it’s officially sold.

No business is sold until the final contract is signed and there’s money in the bank.

So, a better approach could be to work with an off-market business sourcing and M&A partner, like Falcon River. We source potential buyers for you.

Introductions are only made when there’s a great fit between a buyer and a seller. We vet clients so you don’t have to. We wouldn’t make an introduction for a private sale if a buyer wasn’t ready with cash and a clear purchase intention.

We also don’t pressure anyone into a sale. Nor do we take commission or fees from sellers, unlike brokers who usually take 10 to 20% of the final sale price.

Online M&A platforms usually also charge for a listing, premium features, and a percentage of the sale. Plus, selling that way means you’re no longer off-market, and the sale is no longer private.

Work with Falcon River to sell your website: Quick, organized, fair, and zero broker fees.

Key Takeaways: How To Sell a Business Privately

As we’ve covered in this article, there are numerous advantages and ways to sell a business privately.

💡Bonus Tip: MightyDeals Founder, who successfully exited one of several businesses says “Don’t Wait To Cash Out.”

Onfolio is a business aggregator that buys businesses using its own funds and a Special Purposes Vehicle (SPV).

Onfolio has been buying businesses for several years, before and after it listed on the Nasdaq.

One of the businesses it acquired in 2021 was MightyDeals, “one of the world’s most successful daily-deals websites for creative professionals.”

Joel Sacks, founder of MightyDeals, advice on securing a private buyer successfully is: “Don’t wait.”

Don’t wait until the business is going well and on an upward trend. Consider selling then.

Some people wait until their business takes a downturn, but this affects the valuation and the payout you get in the end.

More importantly, never lose sight of the purpose of the business.

Yes it’s your baby, but it’s also a vehicle you use to create an outcome — for example, financial security, lifestyle, or a positive impact on the world.

Sometimes the best thing you can do for the business and yourself is to pass it on. Work with Falcon River to sell your website: Quick, organized, fair, and zero broker fees.