Private Equity (PE) deal flow software is the most time and cost-effective way to track and manage M&A deals for PE firms.

In a sector where relationships are everything, deals are lost or won depending on how well they’re managed.

TL;DR:

- Deal flow software keeps your whole team and partners on the same page while ensuring acquisition and portfolio companies are managed during the entire deal flow lifecycle.

- Unlike CRM or other tools, deal flow software is specifically designed for private equity (PE) firms, capital markets, and mergers and acquisitions (M&A).

Let’s take a closer look at deal flow software for private equity firms looking to buy off-market small businesses with the help of a trusted deal-flow sourcing partner.

What Are Private Equity Deal Flow Software Tools?

Private equity deal flow software tools are crucial for building, maintaining, and monitoring acquisition deals, deal sourcing partners, finance partners, and vendor, relationships.

In private equity, M&A, capital markets, and especially when handling off-market deals, relationships are everything. Your team needs a secure, collaborative, and easy-to-use software solution for managing every relationship in your deal flow pipeline.

PE deal flow software tools are more effective than attempting to use a CRM (customer relationship management), email, Excel, or other communication tools, such as Slack for these vital relationships.

Why Do Private Equity (PE) Firms Need Deal Flow Software Tools?

Relationship management and managing your firm’s deal flow is complex and multi-faceted. Depending on the number of M&A, financing, or off-market deals your team will be dealing with the following in any given month:

- New deal acquisition targets that have come inbound to your firm;

- Deal sourcing partners sending you new potential acquisition targets;

- Performing due diligence with vendors such as lawyers and finance partners of acquisition targets that you’re actively considering;

- Every deal is at a different stage in the pipeline and every deal has numerous moving parts and people to coordinate with (e.g., your team, lawyers, finance, deal sourcing partners, and crucially, the business owner wanting to sell);

- Deals that aren’t a good fit; off-boarding them or referring them to another partner, such as an online broker or platform;

- Deals that have gone through due diligence and are at the closing, signing, and funding stages;

- And everything in between, such as tracking and reporting new deal flows and the efforts your team or vendors are making to bring these in.

It’s impossible to track all of this effectively using email, Excel, or CRM software. Details could easily get overlooked.

Security isn’t on the level required, especially when you’re sending and receiving sensitive financial information and documents. On that basis alone, you risk falling foul of compliance and financial regulations.

None of those staples of business communication and workflow management were designed specifically for PE firms.

Without all of the features your firm, M&A and portfolio companies need, you could make working with acquisition targets, suppliers, financiers, and deal-sourcing partners more difficult.

Thankfully, over the last 10 years, a number of software companies have emerged to meet the needs of capital markets, M&A, and private equity. You’ve now got a range of options when it comes to finding the best deal flow software tool for your PE firm.

Let’s take a look at the features you should look out for when picking the right deal flow product.

What Features Do You Need In Deal Flow Software Tools?

With so many CRM (customer relationship management) solutions on the market, from HubSpot to Salesforce, and everything in between, it can be tempting to use one out-the-box and hope for the best.

However, none of these CRMs and project management tools (e.g., ClickUp, Trello, Basecamp, etc.) are built for the needs of private equity (PE) firms.

PE firms and other businesses in the mergers and acquisition (M&A) space have specific needs that CRMs, PMs, and communication SaaS (Software as a Service) products can’t achieve within your deal flow tech stack.

We’ve compiled the six core features that every PE firm needs from deal flow software tools:

- High levels of security and compliance

- Collaboration and communication (internal and external)

- Automated workflows, ideally AI-powered to save time

- Relationship intelligence: beyond what a CRM can offer, although with CRM-based functionality

- Integrations with other software in your deal flow tech stack

- Needs to be easier to use and more effective than sticking with email or Excel.

Let’s look further into the details . . .

- Security and Compliance

High levels of security and compliance are an absolute necessity for PE software. As a bare minimum, your PE deal flow software should be enterprise-grade secure with SOC 2 and GDPR compliance built-in as standard.

Most CRMs can’t match the minimum required in the financial and private equity sectors. With this level of security, you can be confident every communication and document shared will only be seen by those who need access to that information.

Access control, 2-factor authentication, and audit logs are also important for compliance, especially if any deals were ever audited or had to be investigated.

- Collaboration, Communication

Almost every piece of software that’s designed for multiple users has collaboration and communication features. This is another minimum standard a PE firm needs from its deal flow software.

With these features, your team should be able to keep everything contained regarding every individual deal. So, instead of hundreds of emails flying around about dozens of deals, you’ve got all of the details within separate workflows.

This way, communication about specific deals and important documents (e.g., financials, legal, etc.) will stay contained and accessible to those working on/with them. It will save everyone a lot of time, reduce errors, and ensure deals are completed faster.

- Automated Workflows

Another big time-saver is automation and AI-powered (artificial intelligence) automated workflows.

Imagine if after one document lands ⏤ such as confirmation that a seller-financed SBA-guaranteed loan (Small Business Association) has been agreed for an acquisition target ⏤ your software automatically triggers the next stage of due diligence.

No more reminding yourself or one of your team to do something. Various stages of deal sourcing and the deal processing lifecycle can be managed automatically when you input the right settings. Most of these tools are pretty easy to use, so you shouldn’t need technical skills to manage the software.

- CRM-based Relationship Intelligence

One aspect of CRMs that has transferred over to PE deal flow tools is the ability to see every stage of every deal in its current state. No more thinking, “Where’s deal X at with company Y?”

Everyone on the team involved with individual deals can see the stage it’s at, what’s been done, and what’s still required in order to complete that deal. Keeping workflows simple, the team on the same page, partners and vendors on-target, and the owner of the company you’re buying automatically updated.

All of this is helpful because it reduces friction and increases deal flow efficiency. Several tools come with clever relationship intelligence features that can be leveraged to gain extra insights into the deals you’re currently working on.

- Integrations

Integrations with other software within your deal flow tech stack are always useful. Integrations could be as simple as ensuring deal flow emails are logged in the software, similar to a CRM, and meetings scheduled in your calendar.

Or you could aim for more in-depth integrations, such as with deal flow sourcing tools, software that partners use to send you M&A targets, and financial software integrations.

Providing every integration is enterprise-grade secure with SOC 2 and GDPR compliance built-in then you can be confident in the flow of information, documents, and even money through each system.

- Easier Than Email or Excel

It’s crucial when picking deal flow software that it’s easier and more effective to use than email or Excel. It should have a smoother user experience (UX), and workflows that align with how your team works together throughout the deal pipeline.

If your team starts reverting back to other solutions, such as email, then it could be a sign it’s not the software for your firm. It would be worth doing free trials with a few of the solutions you’re looking at, if that’s possible, to see which is the best option before committing to one of them.

Top 5 Deal Flow Software Tools for PE Firms

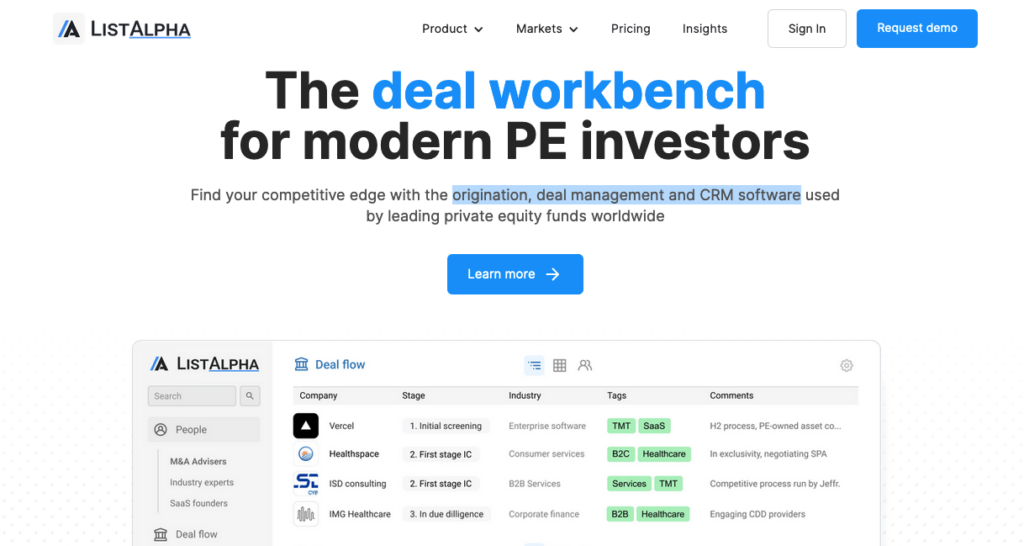

ListAlpha

ListAlpha is an “origination, deal management, and CRM software” built for PE and VC (venture capital) investors and fund managers.

With ListAlpha, you can:

- Maintain a single source of truth for your whole professional network.

- Manage every stage of the deal flow and deal origination lifecycles.

- Benefit from its integrations and powerful search functions.

Pros

- It automatically keeps your contacts up-to-date using third-party data sources.

- Makes it easier to find relevant contacts and details in due diligence documents with AI-powered search capabilities.

Cons

- Not as established as larger players in this market.

- Some features are still in beta as it’s an early-stage company.

Pricing: From $55 per user/per month.

PE Front Office

PE Front Office is a deal flow management software tool for PE.

With PE Front Office, you can:

- Keep all of your deal flow contacts in one place.

- Manage every PE deal from end to end, including fundraising, due diligence, and the legal completion process.

- Customize workflows according to your firm’s processes.

Pros

- Extensive experience providing products that serve middle and back-office functions for PE, VC, numerous funds, and limited partners.

- An extensive range of solutions for every type of capital markets firm, including reporting, compliance, and investor relations.

Cons

- Traditional and in some cases, outdated functionality and user experience.

- Lacks the ease of use and integrations of modern SaaS tools for PE organizations.

Pricing: Customized pricing for every customer, with SaaS or on-site deployment options.

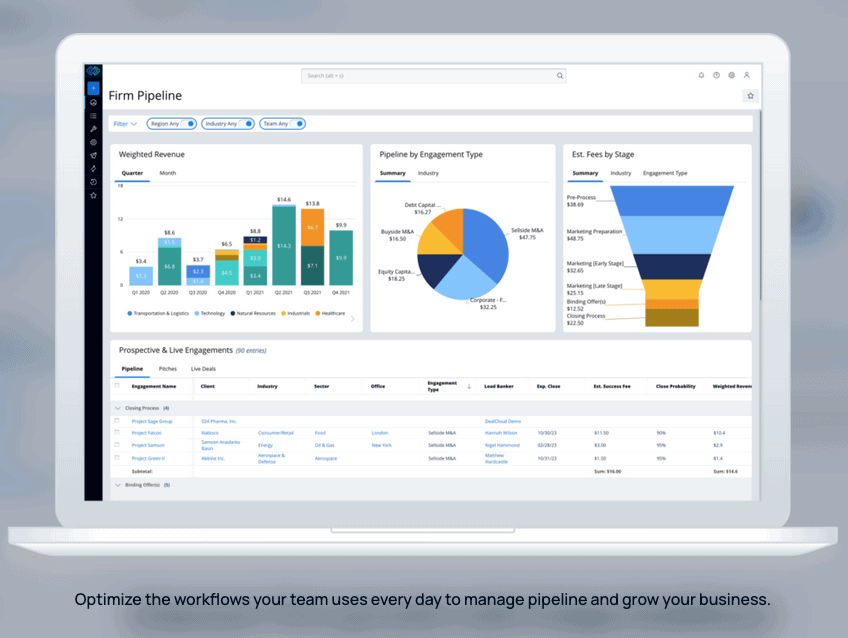

Intapp DealCloud

Intapp DealCloud is a “complete deal and relationship management platform” for PE, VC, and M&A.

With Intapp DealCloud, you can:

- Keep all of your contacts up-to-date with its CRM feature.

- Manage your deal flow and deal origination.

- Improve deal flow with AI-powered features that track and forecast your pipeline.

Pros

- It comes with extensive Microsoft plug-ins and add-ons if you need them.

- It also comes with an AI-powered assistant to improve your deal pipeline workflows: Intapp Assist for DealCloud (AI).

Cons

- Although this is equipped for private capital (e.g., PE & VC), it’s a larger suite of financial tools that serve every sector from accounting to real estate.

- Not all workflows are going to be suitable for smaller-scale financial deals.

Pricing: Customized pricing for every customer.

Globacap

Globacap is a multi-asset solution for private markets investment and asset lifecycle.

With Globacap, you can:

- Create a private deal room for every acquisition, keeping the M&A process contained and in one platform.

- Manage secondary transactions, such as the sale of shares from one of your portfolio companies on a deal-by-deal basis.

- Manage all of your investors within the same platform.

Pros

- Manage every aspect of thousands of potential investments in one solution.

- Your team can even white-label this product if that is needed.

Cons

- More of an investment platform, for PE firms and fund managers to manage investors and transactions.

- A complex solution with multiple tools and features that might be more feature-rich than most mid-cap and off-market PE teams need.

Pricing: Customized pricing for every customer.

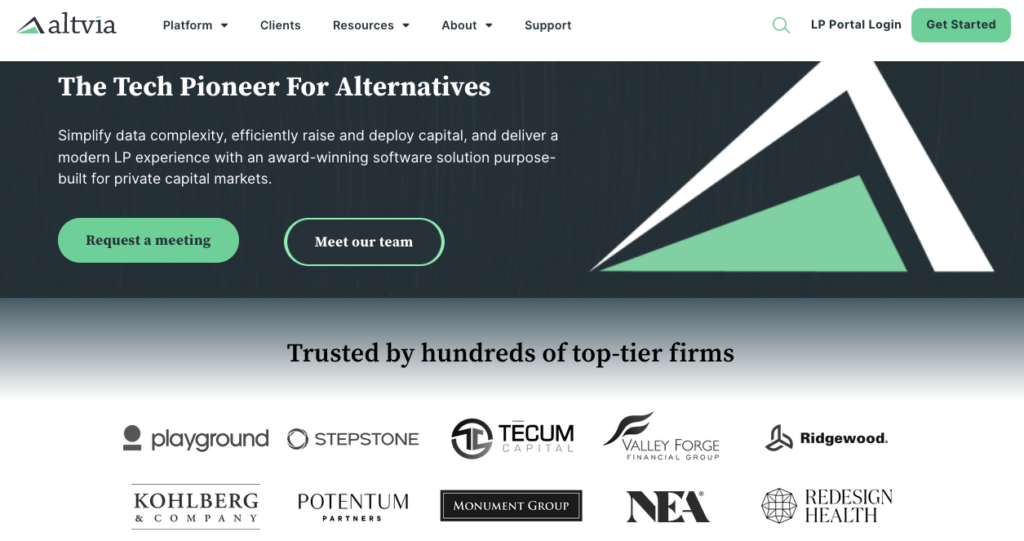

Altvia

Altvia is an award-winning software solution built for PE firms and capital markets.

With Altvia, you can:

- Improve your deal flow and management with a CRM purpose-built for PE firms.

- Benefit from access to more and better-organized data within the CRM.

- Manage your capital deployments and post-acquisition more effectively than using traditional approaches.

Pros

- Lots of powerful features including in-app email tracking, recording, and automated organization tools.

- Rich reporting when fundraising in real-time.

Cons

- Using this is easier if you’re already using Salesforce too, otherwise it can be confusing at first.

- No demo version is available.

Pricing: Customized pricing for every customer.

Key Takeaways: Dealflow Software Management Tools

If I had to recommend just one tool, I would strongly recommend Intapp DealCloud, although the suite of tools is more complex and does have a bit of a learning curve for most, it’s tailored for PE and M&A and is designed specifically for the needs of PE firms.

With robust integration options, particularly with Microsoft products, it fits into most existing tech stacks, and has great security and compliance features as well.

If you are just starting out, I would give ListAlpha a try. While some of the more robust features are not there, the simple and intuitive user interface and AI search capabilities are a good start to begin managing deal flow and contacts when just getting started.

Work with Falcon River when you’re searching for new off-market acquisition deals.