In 2024, private equity deals sourcing strategies fall under 2 umbrellas: network-driven deal sourcing and technology-driven deal sourcing.

It is highly unlikely that 100% of any PE firm’s deals will come through one channel specifically, so private equity professionals need to diversify their deal sourcing strategies to win in a competitive market.

Sihe best deals are off-market companies, PE firms need to invest in the technology, partners, and in-house support that will get them first in line to the right companies.

What is Private Equity Deal Sourcing?

Private equity (PE) is an alternative asset class. PE firms raise funds from limited partners (LPs) and invest in privately owned companies. After managing and optimizing companies for an average of 10 years, PE firms ideally sell those companies at higher valuations than they purchased them, generating returns for investors.

Each PE firm’s deal sourcing strategy is unique.

Depending on their investment industry, conferences and events may be the best way to find new investment targets. For other industries, the right advisor is imperative to finding the best deal.

Some common ways for PE firms to find companies:

- Manually finding companies through Google or LinkedIn

- Using company databases or deal sourcing platforms

- Partnering with bankers and advisors to find the right targets

While there are ways to automate the deal sourcing process, it still takes time to assess which companies are the best fit for a particular firm and if those companies are willing to sell.

Private equity deal sourcing strategies have changed drastically in the past decade because 1) there is more competition in private markets than ever before and 2) technology is changing how PE firms reach their targets.

For PE firms to succeed they need to diversify their strategies.

Private Equity Deal Sourcing Competition Heats Up in 2024

Private equity firms are competing for a limited number of deals. There are only so many companies that fit their target industry, size, location and various other factors that go into their investment decisions. But that has always been in the case. What’s changed in recent years? PE firms are not just competing with each other.

Historically, PE firms paid more than competitors. More often than not, PE firms won deals against competitors like corporate development teams or search funds because of check size alone. There’s hubris in thinking that is still the case in 2024.

According to Jay Jester, Partner at Plexus Capital, the idea that strategics (PE firms) pay absurdly higher multiples is no longer true, even juvenile.

To land the best deals, private equity firms need to search for off-market deals.

They can do this through different routes:

1) Build in-house deal origination teams to source proprietary deals. This requires enormous buy-in from the top-down at your firm.

2) Lean on their network of intermediaries to help them uncover the right companies that have yet to go to market. This requires partnering with firms that specialize in finding off-market deals.

More likely than not, firms will use a combination of tactics and strategies from both routes to find their next deal.

The Two Private Equity Deal Sourcing Strategies

The old way of sourcing deals is no longer effective in today’s competitive climate. No one channel is going to find the best 100% of the time. PE firms need to diversify their deal sourcing strategies to win.

The new deal sourcing strategies fall under two umbrellas: Network-driven deal sourcing and technology-driven deal sourcing.

Technology-driven strategy requires an in-house deal origination team and a built out tech stack. No matter how advanced M&A technology is in 2024, it still needs a human-in-the-loop to use that technology effectively. Using deal sourcing technology means hiring humans to manage that technology. Depending on the size of your firm, that may not be the most effective route to growing your deal pipeline.

The second route is the network-driven strategy that relies on attending events, conferences, and employing intermediaries to introduce your firm to the right companies at the right time. If you have raised a PE fund, you know that connections are everything. The same mentality applies to deal sourcing. You need to expand your network to find off market deals.

While these two routes may seem opposing, modern private equity firms need to employ techniques from both strategies to win. Let’s dive into what each strategy looks like.

Technology-Driven Deal Sourcing Strategy

To build a strong deal sourcing pipeline, a technology-driven deal sourcing strategy requires two elements: an in-house deal origination team and the right technology.

While M&A and deal sourcing technology has changed rapidly in the last few years, In-house deal origination teams are not new.

According to 2014 research from Teten Advisors in “the largest practitioners of origination programs – including Battery Ventures, Great Hill Partners, Insight Venture Partners, Platinum Equity, Summit Partners, TA Associates, and TCV — typically had between 0.75 and 1.25 dedicated deal sources for every generalist investment professional.”

In-house deal origination teams are responsible for finding potential deals. They will likely review hundreds of companies to find 1 potential match that fits the investment criteria. Because of the sheer number of company profiles and outreach that in-house deal sourcing teams are responsible for, they need to employ the right technology.

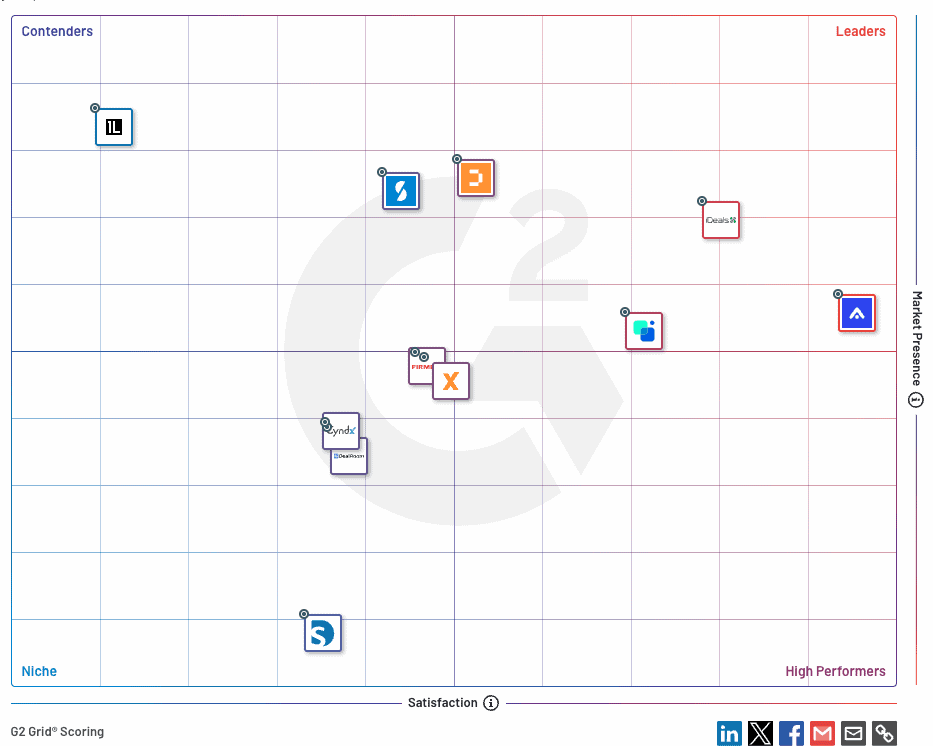

As of August 2024, G2’s top M&A software for private equity are,

- Acquire.com is an online marketplace to buy and sell SaaS startups.

- Datasite Diligence serves as the hub for conducting due diligence, offering a range of advanced data room technologies to optimize deal-making.

- Grata unifies the dealmaking workflow into an all in one solution that helps you find, research, and engage with middle market companies.

- Sourcescrub is a deal sourcing platform for M&A teams who need a complete, accurate, and connected view of private markets.

- Midaxo provides a purpose-built, end-to-end cloud platform that accelerates inorganic growth and reduces deal risk.

The right technology for a private equity firm will depend on their target investments. For instance, Acquire.com specializes in SaaS companies, while Grata provides data on middle market companies.

Each firm should access their own goals to decide the size of their in-house deal sourcing team and the technology they will employ.

With all its systems, bells, and whistles, the technology-driven deal sourcing strategy has one thing in common with the network-driven strategy: It’s still about getting the right people in your network to land your next deal. Technology in and of itself will not close a deal for you. What it can do is help you find the right company, the right contact info, or the right connection to get the right conversations started.

Network-Driven Deal Sourcing

If technology-driven strategies are all about getting to the right people at the right time, network-driven strategies are just classic ways to accomplish the same goal. And guess what? They still work. Deals are still getting done through traditional methods like attending conferences and hiring advisors.

Here are two strategies that fall under network-driven sourcing.

Executive networking. If you are looking to find deals, you need to be talking with CEOs in your industry and sub-industries. You need to be aware of trends and problems these executives are facing and be able to speak to how your firm provides solutions. You can connect with executives in a few ways – the most common are events and conferences.

Intermediaries – The most common intermediaries that private equity firms engage are investment bankers, but intermediaries can be lawyers, accountants, anyone affiliated with the companies you’re looking to acquire. When it comes to building your intermediary network, establish the goals you’re looking for with each relationship.

For bankers and advisors that you partner with for deal sourcing specifically, be sure to vet them thoroughly. Great questions to start with: 1) have they worked in the industries where they are sourcing deals? 2) Can they show examples where they have uncovered off-market deals for their clients?

Regardless of whether your deal sourcing strategies employ in-house deal origination teams, advisors, or a combination of the two, there is one thing that PE firms need to stand out in a competitive market: brand building.

Private Equity Brand Building

Regardless of how much technology vs network strategies your deal sourcing pipeline relies on, all private equity firms need to invest in building their brand.

What does brand building look like for a PE firm?

Building a recognizable, trusted private equity brand means providing value before, during, and after the deal sourcing process. There are a few ways that you can do this:

- Create reports using insights from your current and previous port cos.

- Demonstrate with specific examples how you provide value to your port cos.

In a PitchBook article titled, “PE firms need to double down on adding value”, Glenn Mincey, global and US head of private equity at KPMG said “PEs should be prepared to put in more effort and elbow grease to succeed in a competitive market.”

That effort should be on display on your website, in your LP updates, and any other communication PE firms send. When there is more competition, the firms winning deals will be those that can demonstrate their expertise and value right from the start of the conversation.

Note: If you are a PE firm that can write the largest checks for every deal, feel free to disregard this step. But for those looking to differentiate themselves in a long line of other firms, brand building is a requirement in 2024 and beyond.

Deal Sourcing: Next Steps

Once a PE firm has decided its investment criteria, its deal sourcing goals, and set up the systems that will best help them achieve those goals, the next step is to vet targets.

Outside-in due diligence is the process of compiling all of the public information about a target company to decide if it fits your investment criteria. Unlike publicly traded companies, finding financial information about a private company is trickier, but there are key pieces of information you can deduce without signing a letter of intent or engaging the company’s executives.

Depending on the industry, PE firms can identify a company’s number of employees, competitors, and locations. If the target company’s numbers fall into the right range, the next step is to engage the company.

For PE firms with in-house deal origination teams, this task falls to them. There are a few ways to begin engaging a target company.

- A direct email to the CEO – PE firms will email the CEO and express interest in meeting to discuss the solutions that their firm provides.

- A warm Introduction – This route is much more effective and where PE firms using network-driven deal sourcing strategies shine. When a PE firm is introduced by a respected peer – whether it be another CEO, banker, or board member, that email is less likely to go unanswered in a busy executive’s inbox.

Private equity deal sourcing is a marathon, not a sprint. While it can happen, that first email, phone call, or coffee is not likely to immediately land a deal.

PE firms thinking long-term about their deal sourcing strategies will win out over those chasing gimmicks. What this means is investing in the right relationships, building a brand, and keeping clear, consistent communication with your ideal targets.

A few ways to do this are to set up routine check-ins with CEOs. This can look differently depending on your firm’s bandwidth. You can set automated reminders for a particular person in your firm to send personal outreach or send weekly or monthly newsletter with relevant stories and statistics. Either route (or better yet, both!) will keep your firm’s name top of mind. When the executive is ready to discuss M&A options, you want to be the first firm they call.

Find the Right Deal Sourcing Partner

With private equity deal flow on the rise and more competition than ever, it’s important to find the right partners.

If you’re looking to automate deal flow, look no further than Falcon River. Falcon River is the best-in-class dealflow service that connects qualified buyers and sellers. We are investing in proprietary IP that connects you with the right targets, fast.

Set up a meeting to learn more.